Recognizing Home Equity Loans: Unlocking Your Home's Value

Recognizing Home Equity Loans: Unlocking Your Home's Value

Blog Article

Recognizing the Qualification Criteria for an Equity Car Loan Application

Navigating the landscape of equity finance applications can be a complicated venture, commonly requiring a precise understanding of the eligibility criteria set forth by lending organizations. Delving right into the globe of financial prerequisites, such as debt scores, earnings verification, and debt-to-income ratios, is vital for those looking for to safeguard this type of funding.

Credit Report Demand

What is the minimum credit score required to qualify for an equity loan application? When looking for an equity finance, financial organizations commonly think about the candidate's credit score as a vital element in figuring out qualification.

A credit history reflects an individual's credit reliability based upon their credit report, including factors like repayment history, credit report use, length of credit report, brand-new charge account, and credit scores mix. Lenders use this score to evaluate the threat of providing money to a customer. A greater credit report suggests responsible monetary behavior and minimizes the lender's risk, making it most likely for the applicant to receive an equity car loan with positive conditions.

Earnings Confirmation Process

During the equity car loan application process, the earnings verification action plays a critical role in examining the candidate's financial stability and payment ability. Lenders need evidence of income to guarantee that debtors have the economic ways to repay the finance. Commonly, this entails giving pay stubs, income tax return, and bank statements to validate the applicant's earnings resources and security.

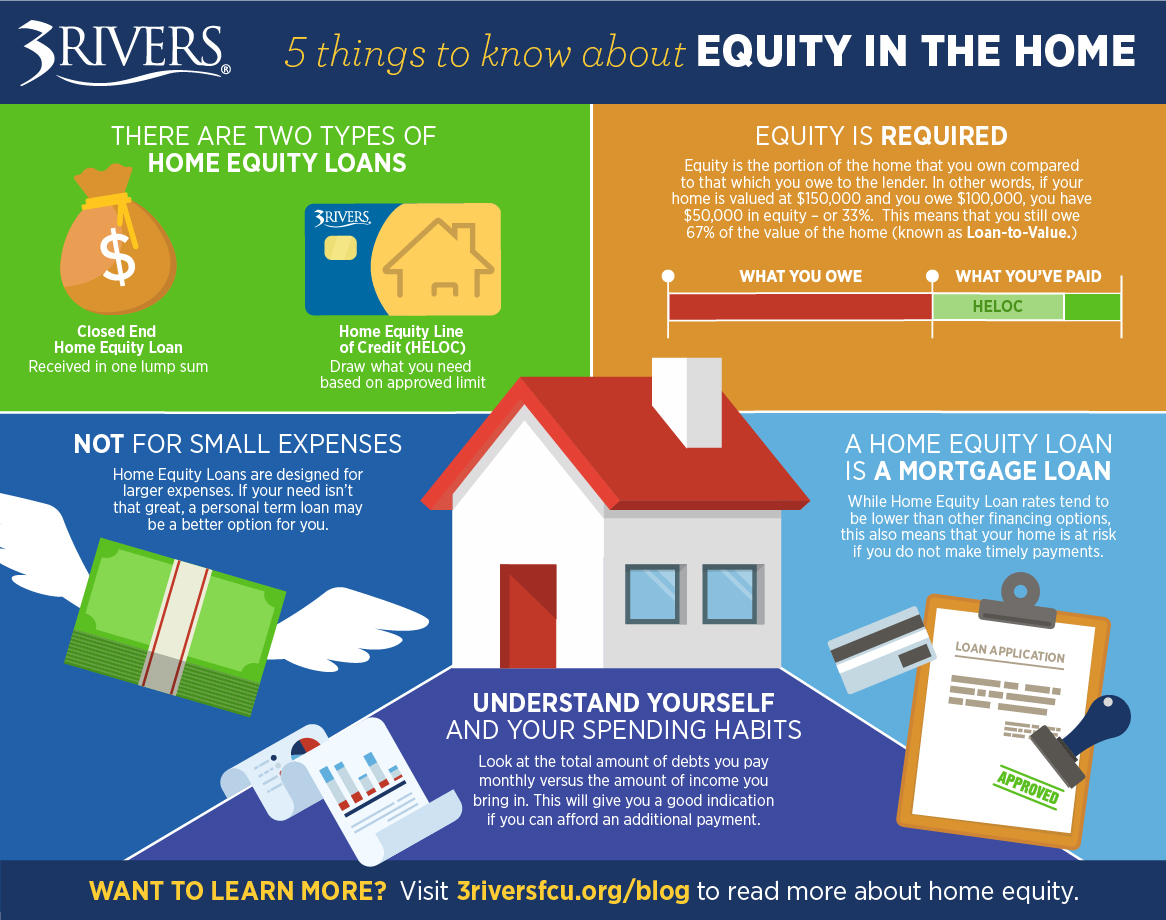

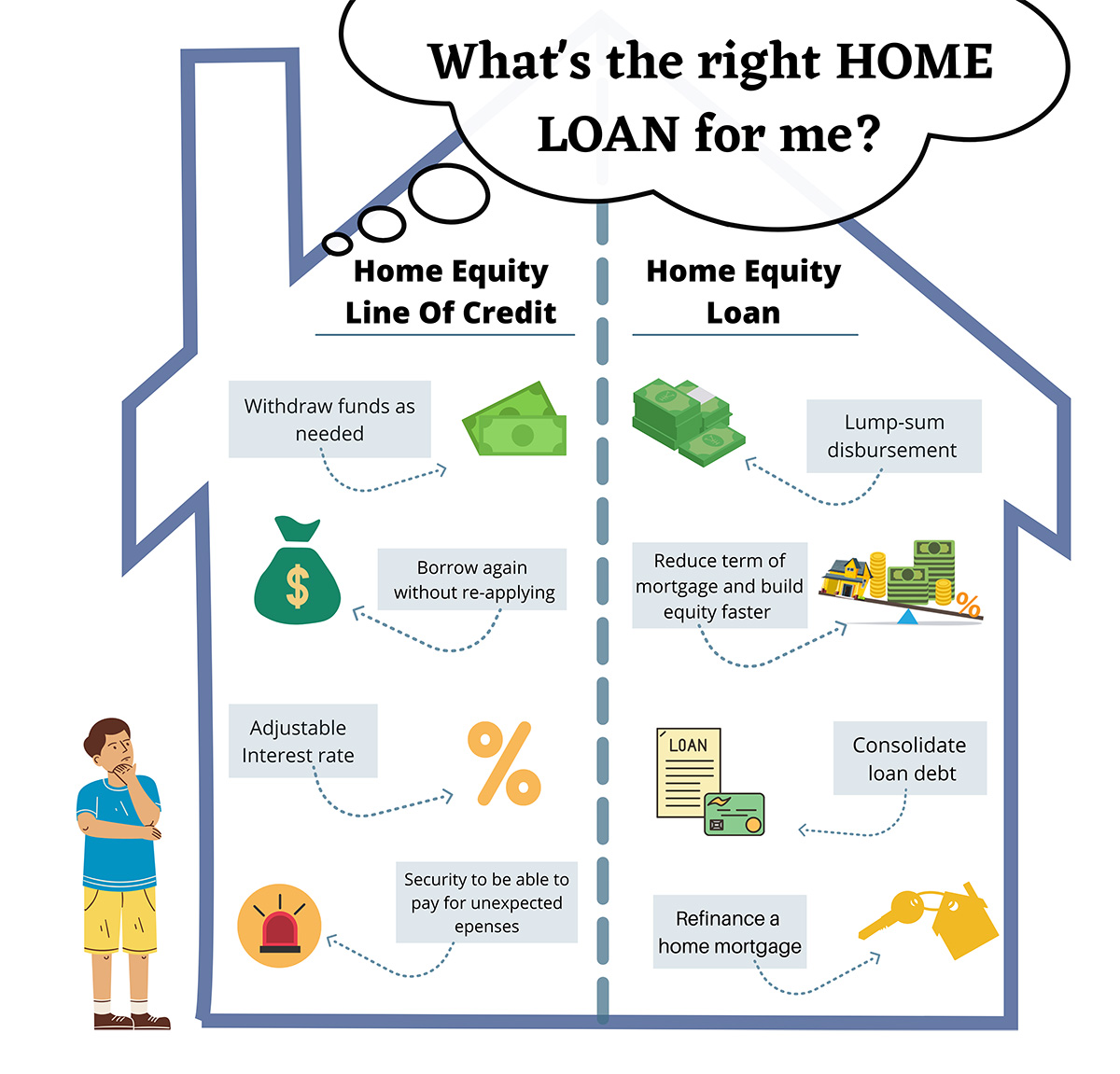

Loan-to-Value Proportion Consideration

The loan-to-value (LTV) proportion is an economic term used by loan providers to share the proportion of a financing to the worth of an asset bought. In the context of equity loans, the LTV proportion is computed by separating the total exceptional lending quantity by the assessed worth of the building.

Lenders generally have maximum LTV ratios that they want to approve for equity lending applications. This ratio works as a measure of threat for the lender, as a greater LTV proportion implies that the debtor has much less equity in the residential or commercial property and may go to a greater danger of default. Debtors with reduced LTV proportions are normally seen as less dangerous and may be supplied a lot more favorable loan terms, such as reduced rates of interest or greater financing quantities. Understanding and taking care of the loan-to-value ratio is vital for debtors seeking equity fundings.

Debt-to-Income Proportion Examination

Reviewing the debt-to-income ratio is a crucial part in the assessment of equity lending applications. A lower debt-to-income proportion indicates a healthier financial situation, making the customer a lot more most likely to qualify for an equity lending.

Lenders commonly have maximum debt-to-income proportion requirements, usually around 43% to 50%. Exceeding this threshold may lead to the car loan application being refuted. Debtors can boost their debt-to-income ratio by settling existing financial debts, enhancing their revenue, or reducing their regular monthly expenditures.

It is essential for individuals considering an equity lending to analyze their debt-to-income ratio in advance. This analysis not only impacts funding approval however additionally affects the funding amount and interest price used. By preserving a healthy and balanced debt-to-income proportion, consumers can improve their possibilities official site of securing an equity finance on favorable terms.

Property Evaluation Importance

Why is property assessment important in the equity car loan application procedure? Residential or commercial property assessment plays a crucial function in determining the worth of the home being used as collateral for the equity funding. Lenders need a property evaluation to ensure that the worth of the building straightens with the financing quantity being asked for. This is vital for the loan provider to evaluate the risk associated with providing the loan and to shield their financial investment.

Residential or commercial property appraisal is essential as it offers a unbiased and specialist analysis of the home's current market price (Equity Loans). This valuation assists the lender establish the loan-to-value ratio, which is an essential aspect in deciding the regards to the lending. A greater appraisal worth might lead to extra beneficial car loan terms for the consumer, such as lower passion rates or a greater loan quantity

Furthermore, residential property evaluation assists in avoiding fraud and makes sure that the residential or commercial property's worth is properly represented. By getting a comprehensive evaluation record, lenders can make educated decisions relating to the financing application, inevitably profiting both the loan provider and the consumer.

Conclusion

To conclude, understanding the eligibility standards for an equity lending application is important for possible borrowers. Elements such as credit rating, earnings verification, loan-to-value ratio, debt-to-income proportion, and building evaluation all play a considerable duty in figuring out whether a candidate will certainly be accepted for an equity lending. By satisfying these requirements, individuals can boost their opportunities of protecting the financing they need for different monetary purposes.

The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a finance to the worth of a property acquired. In the context of equity loans, the LTV proportion is computed by separating the complete superior financing quantity by the evaluated worth of the residential property. Borrowers with lower LTV ratios are generally seen as much less high-risk and might be used much more beneficial car loan terms, such as lower interest prices or higher lending amounts. A greater evaluation value may result in extra desirable finance terms for the debtor, such as lower interest rates or a higher finance quantity.

Factors such as credit rating rating, earnings verification, loan-to-value proportion, debt-to-income proportion, and residential or commercial property evaluation all play a significant role in determining whether an applicant will be authorized for an equity car loan. Alpine Credits Equity Loans.

Report this page